By Joseph Y Calhoun III, President of Alhambra Investments

The Fortress Portfolio is our original asset allocation strategy. It is the genesis of our company, the very reason I founded the firm. It was designed at the request of a client back around the turn of the century.

Alhambra Investments began with a question.

“Can you create a portfolio for me that will have double-digit returns and no down years?”

It was 2000 and I was still working at a big Wall Street firm. At that time, I traded options and stocks for large institutional clients, mostly hedge funds. However, I did have a few retail clients, like the one posing the question. He was about to retire and looking for an investment strategy to safeguard and grow the wealth he had built over many years. He was also a personal friend, who was justifiably worried about a very speculative stock market.

I told him I would see what I could do. Yet, a big part of me was thinking it would be a waste of time. Didn’t everyone want a portfolio that could make 10 percent or better returns without down years? If it was possible wouldn’t someone have figured it out by now? What I did know about portfolio theory did not seem all that promising. The favored approach was the 60/40 stock and bond portfolio that despite producing decent returns since 1926, lost money in almost a quarter of those 90 years. So, I knew I would need to look elsewhere for answers.

As I reviewed different theories, I increasingly became drawn to the Permanent Portfolio developed by Harry Browne. His approach divides a portfolio equally between stocks, long-term Treasury bonds, cash, and gold. The divisions are based on four economic observations. Prosperity is good for stocks and bonds. Recessions are good for cash. Deflation is good for bonds and cash. Inflation is good for gold. The performance of this portfolio was good at about 10 percent since 1972. But the returns were not consistent. There were more down years than my client wanted and extended periods of disappointing returns.

The more I studied the Permanent Portfolio, the more I realized that this wasn’t my answer, but it was pointing me in the right direction. Browne’s idea of connecting his portfolio to specific economic environments and investments that would perform well in those environments had merit. In the Permanent Portfolio, I saw a machine that worked. Not as efficiently or reliably as needed. But I began to suspect that I could take apart the portfolio engine at its heart, re-engineer it, and make it better.

Engineering an Investing Process

Before I was an investment professional, I spent eight years in the Navy’s Nuclear Submarine program. In the nuclear Navy, and particularly on submarines, there is a process, a procedure for everything, down to how to flush the toilet. Now, I drew on that experience as I began to construct an investing process, a portfolio operating manual. Browne was right that different investments perform better in different environments. But my research found that it isn’t mere growth or recession that moves stock prices. Rather it is growth that is better or worse than expected that moves stock prices. This is an important distinction and explains why stocks can occasionally perform better in a bad economy versus a good one, provided the bad economy is better than feared.

Another important insight was that the value of the U.S. dollar has a much bigger impact on investments than mere consumer inflation. The value of the dollar influences not only inflation but also global capital flows. Both influence market returns across asset classes.

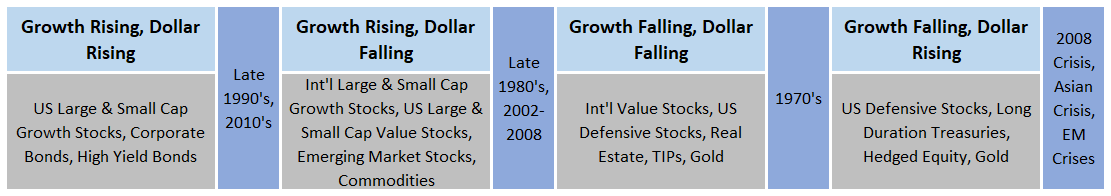

The investment strategy that resulted from this process is one that can thrive in any of four distinct economic environments:

- Growth Rising, Dollar Rising

- Growth Rising, Dollar Falling

- Growth Falling, Dollar Rising

- Growth Falling, Dollar Falling

The portfolio I was building needed to operate efficiently across all four environments.

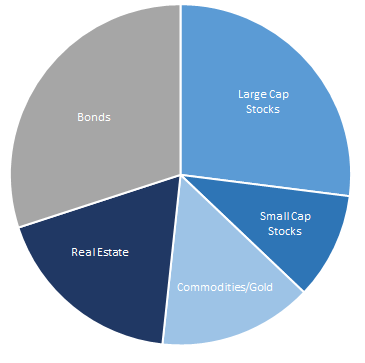

My research led me to identify five distinct assets that stood out for their performance in the four investing environments:

- Equity of Large, Established Companies

- Equity of Small Companies

- Real Estate

- Commodities

- Bonds

Ultimately, I was able to develop a strategy that had very few down years and strong overall returns. That strategy was used to construct what we now call our Fortress Portfolio.

The First Fortress

The original Fortress portfolio was constructed as a moderate risk portfolio with 40% bonds. We have since developed multiple risk portfolios with varying amounts of bonds from 0% (most aggressive) to 60% (most conservative). The ratio of risk assets in each of these portfolios is the same as the original. Today, we use the 30% bond allocation portfolio as the default moderate risk portfolio.

In constructing this Fortress Portfolio from the Fortress strategy, we had to make some tactical choices. Which Large Company Stocks will be included? What commodities? What form will these investments take? Mutual funds? ETFs? Individual securities? These are tactical choices. For the basic US Fortress Moderate risk portfolio, we made the following tactical decisions:

- Large Company Stocks – S&P 500

- Small Company Stocks – Russell 2000

- Real Estate – Dow Jones REIT Index

- Commodities – 50% Gold, 50% Goldman Sachs Commodity Index

- Bonds – 3-7 Year Treasury Index

All of these investments can be bought via an index ETF or mutual fund.

A further tactical choice for the Fortress Portfolio was to make it passive with a one-year rebalancing period.

Today, with the plethora of ETF choices, we can construct a wide variety of custom, strategic portfolios by making different tactical choices.

Over the period for which we have asset class returns, stretching back to 1972, the original version of the moderate risk Fortress portfolio produced a return consistent with the standard 60/40, stock/bond portfolio but the addition of low and/or negatively correlated assets reduced the volatility of the portfolio by a little over 20%. The importance of that change cannot be overstated. Lower volatility means lower stress and better decision making. The biggest challenge for most investors is sticking to their strategy during down periods. Lower volatility leads to better decisions.

The moderate version of the original Fortress model didn’t meet my clients’ requirement of no down years but it was a big improvement from standard Wall Street fare. Since 1972 the portfolio has produced a negative return about every 5 years There have been a total of 9 down years but the magnitude of the average down year is about 25% less than the stock/bond only portfolio.

The goal of the Fortress is to perform well in all four economic environments. A decade-by-decade review shows it accomplishes that goal. It underperforms slightly worse than the stock/bond portfolio during strong dollar periods (such as the 1990s), but more than makes up for that in weak dollar periods (2002-2008). I think that is important because the long-term trajectory of the dollar is down since the end of Bretton Woods. And after a strong dollar decade in the 2010s, we may be due for another period of weakness.

Back in 2000, my research was the beginning of a customized approach to managing one client’s money, so he would have a prosperous retirement, even as the Nasdaq and S&P 500 stock exchanges were on the precipice of severe bear markets. The engineer in me knew I had developed something that in many aspects was before its time. Quite simply back then, the parts did not exist to build this machine in volume for mainstream investors. But by 2006, when I founded Alhambra Investments, the tools to easily construct and run such a portfolio for regular folks were widely available in the form of exchange-traded funds (ETFs) for bonds, real estate, and commodities.

To my surprise, answering my client’s question had not led me to a dead end. Rather, in 2000, I was only beginning to travel down a promising road, where I would leave my old broker life behind, to engineer comprehensive portfolios largely for individual investors. Today, the Fortress Portfolio is the foundation for all the portfolios we run at Alhambra Investments (See Below). Our actively managed portfolios use tactical overlays to make changes to the Fortress allocation under certain conditions.

Looking back, I can now see that Alhambra Investments began with that simple question from a friend—a question that would lead to the very founding of the firm in 2006.

*Any return data cited is gross of fees, total return. The 60/40 portfolio cited uses the Vanguard Total Stock and Total Bond portfolios. Past results are not necessarily indicative of future results. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading or the costs of managing the portfolio. Also, since the trades have not actually been executed, the results may have under or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Stay In Touch