The Alhambra Portfolio builds on the Fortress and Citadel portfolios by adding individual securities to the portfolio. The Fortress and Citadel portfolios use ETF’s and mutual funds to fulfill their strategic and tactical mandates. The Alhambra adds carefully selected securities of individual issuers in addition to funds, both indexed and active.

In the Citadel Portfolio, we use ETF’s and mutual funds to fulfill the large and small company stock portions of the portfolio. In the Alhambra Portfolio, we substitute a portion of the equity allocation with one of our Individual Stock portfolios. We manage two different strategies:

Archer (Value, Quality & Momentum) – VQM screens a universe of global equities based on value, quality, and momentum criteria. Momentum in this case refers to earnings momentum.

Fortalice – This model uses earnings revisions as the foundation for stock selection. The model de-emphasizes the value part of the VQM portfolio.

The Alhambra Portfolio may also include individual securities and actively managed funds in other asset classes.

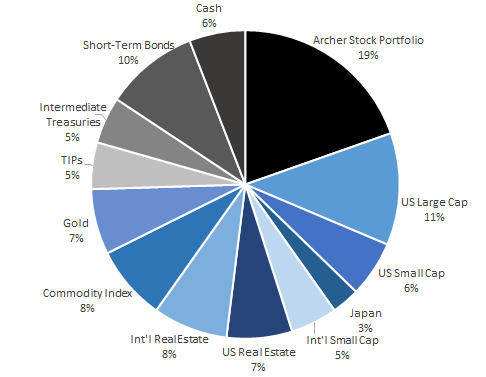

A fully invested Alhambra Portfolio might look something like this:

Stay In Touch