The towering walls and smartly constructed defenses of the Alhambra fortress secured the wealth within for centuries. Similarly, our Citadel Portfolio is designed to safely grow your wealth over time in today’s high-risk environment. Built upon the strategic Fortress framework, the Citadel Portolio is an actively-managed version of the Fortress architecture.

We make some simple tactical choices to construct a Fortress Portfolio but it doesn’t change once those basic tactical choices are made; it is passive. The Citadel Portfolio allows those original tactical choices to be altered based on prevailing conditions. We make these tactical changes based on several factors:

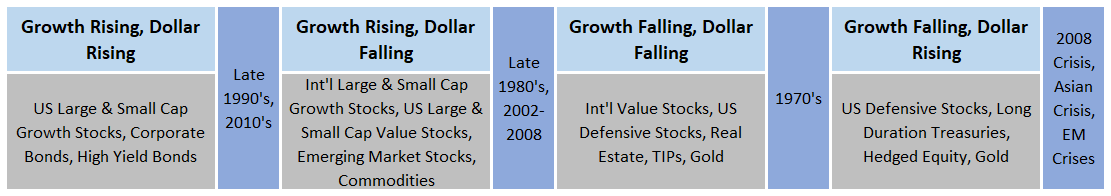

> Economic Environment: As discussed in the Fortress Story, we developed the Fortress strategy to thrive in four different economic environments. We have identified assets that perform best in each of those environments and can make tactical changes to the Citadel Portfolio based on the prevailing economic environment.

> Macro-Economic Factors: We use a small number of economic indicators to identify the onset of recession and recovery. These indicators can be used to adjust the portfolio accordingly.

> Momentum: We use momentum to confirm the choices we make based on the first two factors. Momentum can also be used to make smaller incremental adjustments across asset classes, sectors and industries.

Economic Environment

We define the economic environment by the trend of the dollar and US economic growth. The trend of the dollar impacts returns through currency values and also capital flows. Currency trends tend to be persistent because a rising currency attracts capital flows which lead to further gains. Capital inflows also positively impact growth which reinforces the trend. The value of the dollar is also inversely correlated with real assets like commodities and real estate. We track the trend of the dollar via trade-weighted indexes as well as through individual currencies.

Economic growth impacts currency values and capital flows but it also impacts asset class returns. Safe assets such as bonds and gold will outperform during periods of falling growth (contraction; recession) while growth assets will outperform during periods of rising growth. We have identified assets that are likely to outperform in each of the four economic environments.

Macro-Economic Factors

The Citadel approach also considers the macro-economic environment. Recessions are fairly rare events but have a large impact on all markets. Identifying the onset of recession in advance is a powerful tool for adjusting asset allocation. We have developed a methodology for identifying these inflection points.

Any successful macro-economic adjustments to a portfolio must avoid false signals. Unnecessary trading increases costs and decreases tax efficiency. We avoid overtrading by limiting the indicators we use to gauge economic performance and the probability of recession.

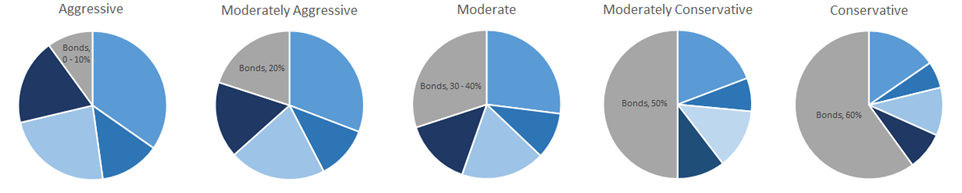

The Citadel Portfolio starts with the sound strategic allocation of the Fortress Portfolio:

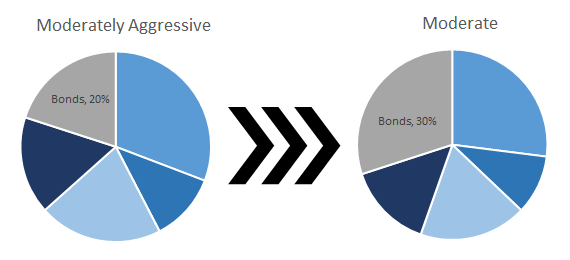

Citadel clients, in consultation with their Alhambra adviser, choose a baseline risk portfolio from 0% to 60% bonds. Our macro-economic adjustments will shift your allocation based on the economic outlook. If our indicators show a slowdown in economic growth, your portfolio will shift from the baseline portfolio to the next, more conservative allocation:

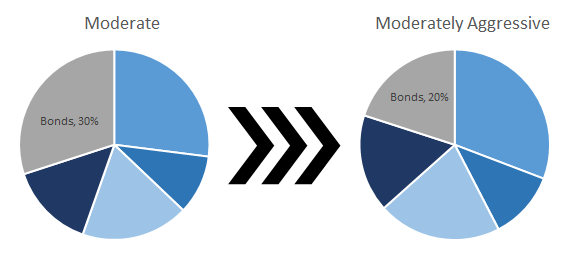

If our indicators show an acceleration of economic growth, your portfolio will shift from its current allocation to the next more aggressive allocation:

The adjustments can be more extreme when our indicators show a high probability of imminent recession or an approaching exit from recession.

Economic growth will slow and accelerate multiple times through the course of a business cycle. Sometimes the change will be small and other times quite large but the Citadel portfolio is not designed to catch every minor change. Most of the time your portfolio will be invested in your baseline allocation.

Our Indicators

These are some of the indicators we use to judge the current state of the economy:

> Yield Curve: The yield curve – the difference between short and long-term interest rates – has been identified through numerous research papers as the most accurate indicator of future economic growth.

> Credit Spreads: Credit spreads – the difference between junk bond and Treasury yields – are also predictive of future economic growth but must be used in conjunction with the yield curve to provide actionable information.

> US Dollar: The trend of the dollar provides insight into global capital movements. Countries that are performing well economically will generally have stronger currencies than those that are not.

> High-Frequency Economic Data: We analyze every economic report for trend purposes.

Momentum

The momentum anomaly is well known in finance and can be observed in all financial markets. It is nothing more than the tendency for rising asset prices to rise further and falling prices to continue falling. Research has shown, repeatedly, that assets with strong past performance continue to outperform assets with poor past performance in the next period. Optimal measurement periods can be different for different assets but all asset classes exhibit this behavior.

We use momentum to confirm the trends we see in the US Dollar and the macroeconomy. We expect certain assets to outperform in a given economic environment but there have been exceptions in the past. These are not rules carved in stone. We wait to see markets act as we expect before committing to an investment. Momentum is also used to confirm trend changes in the dollar and the economy.

The Citadel Portfolio starts with the asset allocation of our original Fortress Portfolio. The portfolios are constructed using ETFs and/or mutual funds for each asset class in the Fortress allocation. Half of the Citadel Portfolio will always be in this strategic allocation. The other half of the portfolio is tactically adjusted based on the economic environment, macro trends, and momentum.

It is this combination of a diversified strategic plan – the Fortress Portfolio allocation – and intelligent tactics, that together produce a dynamic, tactically adjusted Citadel Portfolio.

The Citadel Portfolio, the end result of our extensive research on the global economy, is designed to grow wealth in a structure that prioritizes safety and security. The strategic framework of the Fortress Portfolio provides a more consistent result than the traditional stock and bond portfolio making it ideal for pre-retirees and retirees. The tactical changes seek to improve on the already impressive track record of the Fortress Portfolio.

Customization

The Citadel Portfolio can be customized to reflect your strongly held views. Tell us about your views or concerns and we can probably address them.

Example: The Citadel is constructed with a domestic (US) version of the Fortress portfolio. If you feel strongly that you do not want a US emphasis, we can construct a custom Citadel that uses an international version of Fortress as the base.

Stay In Touch